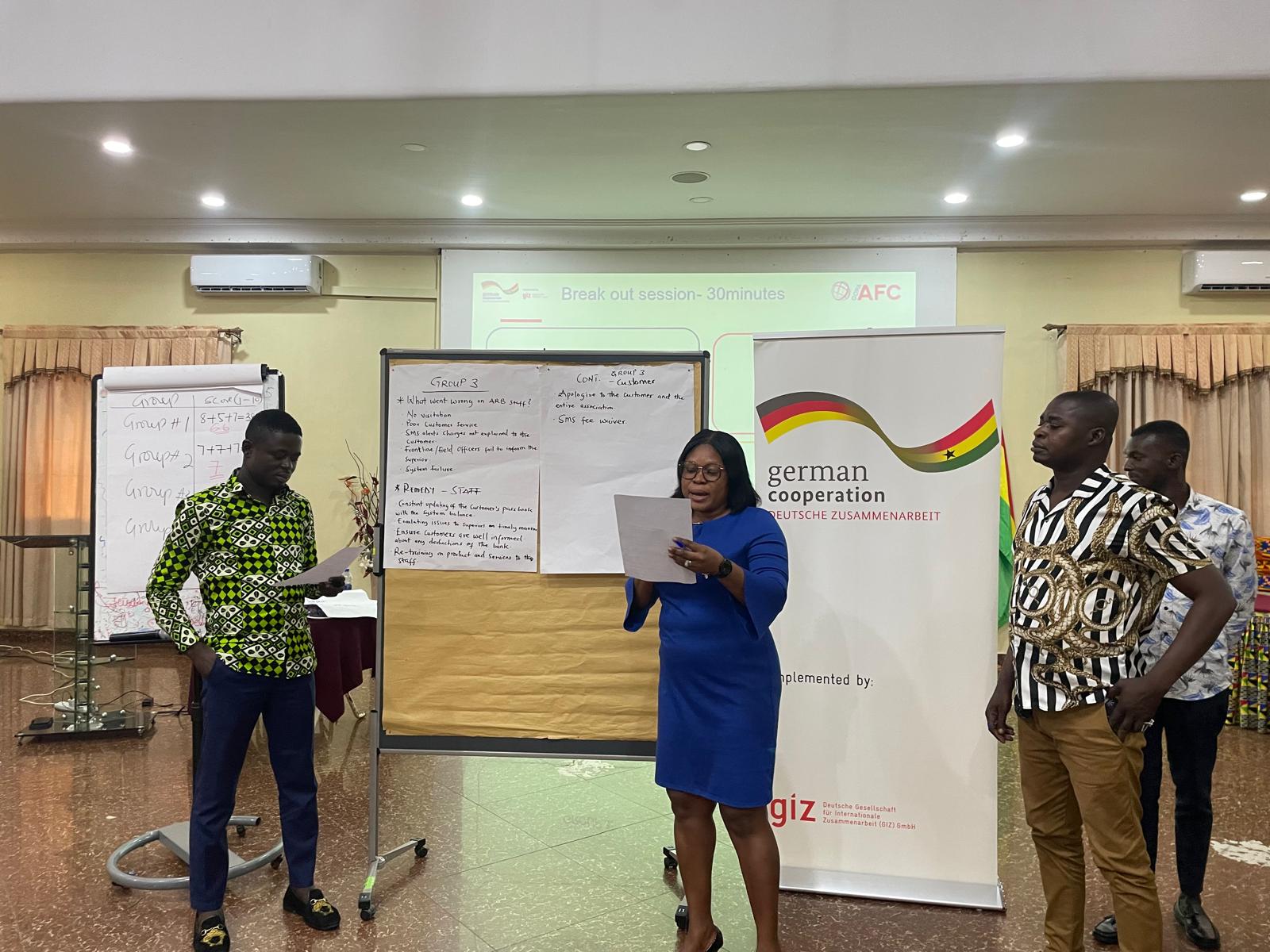

Our experts, Samuel Kojo Darko and Binyam Tadesse, have recently conducted series of comprehensive trainings (both classroom and on-the-job) for over 220 banking staff across four partner financial institutions (PFIs) in Ghana. This activity is a key deliverable for our GIZ Project, "Capacity Building for Partner Banking & Microfinance Institutions” in Ghana. The trainings aimed to enhance the delivery of financial services to better meet the needs of micro, small, and medium enterprises (MSMEs).

Key Topics Covered

The training sessions, that took place in Accra and Kumai, focused on essential areas including:

- MSME Product Development: Introducing innovative and pioneering new products tailored for MSMEs.

- MSME Credit Risk Appraisal: Emphasizing a cash flow-based appraisal system using a new innovative loan appraisal tool that integrates character and cash flow analysis, loan structuring, and effective lending decisions.

- MSME Sales and Marketing: Developing strategies for forming partnerships with MSME associations and leveraging active referrals to reach potential MSMEs.

Driving Impact: Tailored Financial Solutions for MSME Growth

This initiative not only promotes MSME finance in Ghana but also emphasizes the development of demand-driven financial services tailored to entrepreneurs' needs. The training empowers partner financial institutions to offer customer-centric products that help MSMEs grow and thrive, ultimately leading to job creation.

Participant Feedback

Here’s what participants are saying about our recent trainings:

- "The training has sharpened my technical skills in MSME credit appraisals. I recommend that such trainings be delivered regularly for effective MSME credit delivery."

- "The strength of the training included the cash flow analysis and credit risk assessment."

- "Regular training sessions are essential to enhance our approach to new products."

- "The training was very practical, and the presentation was delivered at a great pace."

- "It was interactive, and all participants were fully engaged."

- "The training was tailored to the right audience for implementation. I recommend offering such sessions periodically."

Progress and Achievements

The project, which aims at building the capacity of partner banking and microfinance institutions in developing financial products for MSMEs, has made substantial progress so far. During the inception phase, tailored activity work plans were crafted for each partner financial institution (PFI), including rural banks outside of Accra. Meetings were held with PFIs to delineate key activities in the work plans, paving the way for effective project implementation.

We have now established strong relationships with all nine PFIs and have kick-started activities with five of them, where competitor analysis and market research have been conducted. Additionally, engagements with 14 MSME sector associations in Ghana have been established to understand their financial needs, fostering a robust network for collaboration.

Looking Ahead

This project is committed to building the capacities of nine different partner financial institutions, including savings and loans companies, rural and community banks, and microfinance institutions. Our priority is to relentlessly enhance MSME product development, ensuring that entrepreneurs have better access to the financing they need to thrive.

Together, we’re creating a stronger, more inclusive financial landscape for MSMEs in Ghana!