Agriculture & Finance Consultants GmbH (AFC) is a private German consulting firm focusing on agriculture/agribusiness and financial sector development projects in developing and transition countries (https://www.afci.de/). We employ 47 permanent staff members at our headquarters in Bonn/Germany and on average contract 50 long-term and more than 350 short-term consultants throughout the year implementing projects for various donor organizations (e.g. EIB, KfW, GIZ, World Bank, AFD, EBRD). In 2007, AFC became a member of GOPA Consulting Group, Germany's largest group of consulting firms in development cooperation.

Objective of Project

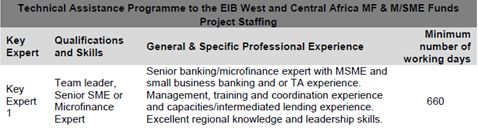

AFC is preparing the tender documents for the EIB Technical Assistance Programme to the EIB West and Central Africa MF & M/SME Funds. The purpose of this technical assistance operation is to support EIB partner FIs in West and Central Africa to deploy funding in an efficient, responsible and sustainable manner, in accordance with the EIB’s standards and requirements through capacity building and technical assistance, thereby safeguarding the EIB’s reputation and investments.

AFC is currently managing two similar EIB Technical Assistance projects in East Africa and in Eastern Europe with a focus on MSME finance. For further information please visit http://www.ta-eca.eu/ .

Scope of Work

In relation to the responsibilities of Team Leader, Key expert 1 (KE1) shall be responsible for the delivery of all services and deliverables under this contract. KE1 will be responsible for coordinating and validating technical assistance initiatives with the FIs and Final Beneficiaries as well as the EIB, mobilising TA initiatives with long-term experts and short term experts.

Qualification and Skills:

- At least a University degree, preferably at Masters’ level, in Business Administration, Economics, Finance, Banking, or related field;

- Full fluency in English and/or French with a strong working knowledge of the other is required;

- Computer literate;

- Educational / trainer certification would be an asset.

General Professional Experience

- KE1 should have an in depth knowledge of MSME lending, microfinance and/or banking sector, as evidenced by 10 years recent professional experience (either working for an inclusive financial services provider or delivering direct capacity building to FIs in the last 15 years);

- Good management skills as evidenced by 5 years in a recent senior management role at least as COO/CFO level in the last 15 years;

- Good knowledge of donor/DFI financing programmes as well as knowledge of Know Your Customer and AML procedures, as well as Social and Environmental standards would be an asset

- Experience of working in a senior expert/management position on donor/DFI financed TA operation projects or a proven track record of developing and implementing innovative financing products in the past 5 years would be an asset;

- Previous experience of assisting financial institutions to improve their social performance/achieve SMART certification and knowledge of the USSPM would be an advantage.

Specific Professional Experience

- Strong regional experience as demonstrated by 5 years of relevant international professional experience (based outside the country of origin) of which 2-3 years should have been spent managing financial services activities in sub-Saharan Africa preferably in at least one of the countries of West and Central Africa;

- Practical experience and proven track record in organising and delivering professional bank and/or microfinance training/coaching programmes in developing countries;

- 5 years practical experience and proven track record in managing the provision of successful capacity building activities to FIs such as microfinance institutions or banks, including, for example; conducting needs assessments and analysis of results, development of subsequent training and coaching plans, development of curricula and training materials, organisation and delivery of trainings;

- Fully conversant with market and financial risk analysis techniques (including AML/CFL and compliance), and ability to implement computer based models to analyse balance sheets and calculate key financial ratios for lending analysis and meeting banking requirements (e.g. Basel).

Interested candidates please send their most recent CVs to Barbara.Braun [at] afci.de until January, 30 2019 latest.

Kindly note that the suitable expert will be required to present certificates of all underlying assignments in the course of the tender process, as a requirement by the EIB.