Background:

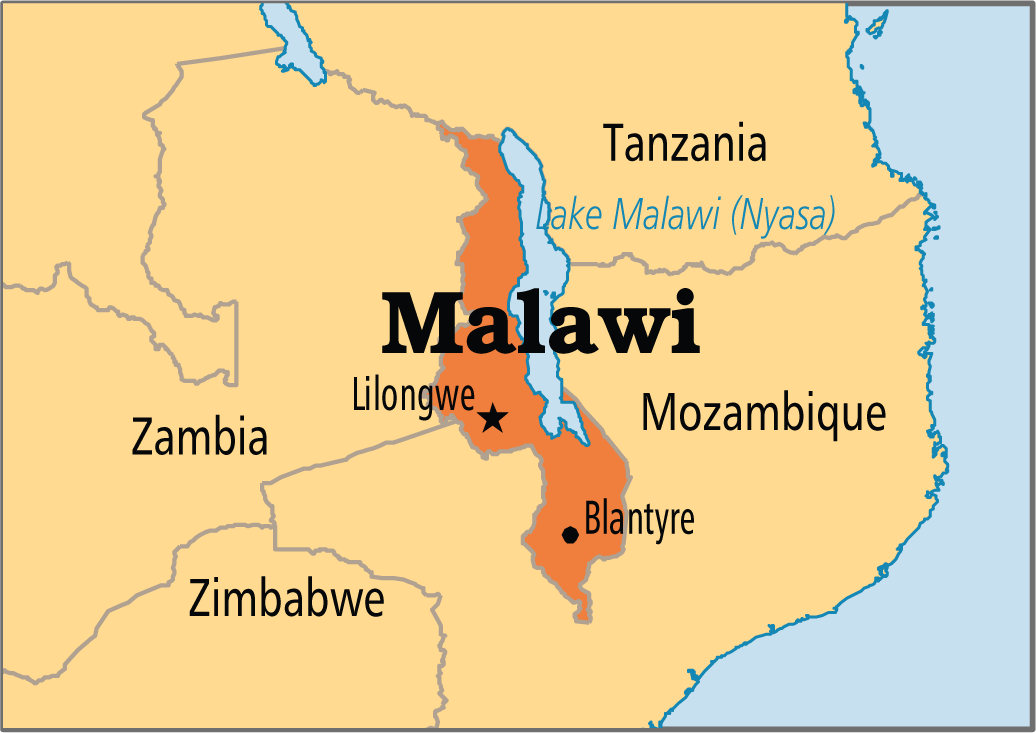

The MicroLoan Foundation Malawi (MLF Malawi) and Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) are embarking on a project to improve livelihoods of smallholder farmers through greater agricultural productivity and more sustainable practices of natural resource use in Malawi.

The project will work towards developing and testing an ESG-compliant loan product.

A second phase of the project, subject of a subsequent tender, will then focus on launching the developed financial loan product coupled with a savings product.

Project Activities/Tasks:

- Development and integration of an ESG framework into MLF Malawi’s operating procedures including but not limited to staff and clients training, loan assessment procedures, and effective ESG compliance monitoring.

- Identification of three bankable ESG compliant investment opportunities and development of business models for the demand side.

- Based on business models identified, development of two categories (secured and unsecured) of individual loan products.

- Analysis and – if necessary – strategy for adaptation of internal processes and procedures to ensure product can be rolled-out successfully.

- Assessment of the risk and impact of including men in the lending portfolio – recommendations on gender strategy.

- Training of staff in one pilot branch on ESG compliant individual loan product.

- Testing of ESG compliant digital individual loan product with 50 MSMEs and smallholder farmers

Tasks of the Team Leader:

- Overall responsibility for the advisory packages of the contractor (quality and deadlines), for overall planning, management, execution and quality control of all tasks as well as reporting under this contract.

- Coordinating and ensuring communication with GIZ, MLF Malawi, partners and others involved in the project.

- Personnel management, identifying the need for short-term assignments within the available budget, as well as planning and steering assignments and supporting local and international short-term experts.

- Conduct market research to conduct research with 300 clients and markets in 22 operational areas.

- Examine demand and supply variables, market opportunities, potential challenges, bottlenecks, and appetite for launching ESG-compliant digital individual loan product.

- Identify and give recommendations of a minimum of three ÉSG compliant bankable investment opportunities and appropriate business for demand and supply side.

- Organize workshop to present business models for selection of bankable investment opportunities and suitable features for ESG compliant loan product.

- Develop staff training materials and deliver staff training to 18 HQ staff, 1 Branch Manager and Client Officers in pilot branch on ESG compliance and individual loan product.

- Together with MLF Malawi and GIZ, select one branch to pilot ESG compliant individual loan products. During the testing process, adjust product and client training materials.

- Develop two categories of ESG-compliant digital individual loan products (secured and unsecured) that is aligned with the investment and with particular focus on the agricultural sector and food system.

- Analyze options to cooperate with input or equipment providers and to bundle additional services for farmers.

- Set product features. Establish loan limits and minimum saving amounts for each category based on client risk profile.

- Update operational procedures and policies to deploy and manage individual loan products (secure and unsecure) and develop risk management framework.

- Map and document the customer journey of clients in testing process.

- Develop the process and documentation required to ensure that regulatory and risk management requirements are met, particularly around KYC, the loan contract, and if required, that the collateral is properly registered and enforceable in case of client default.

- Develop and document a loan origination process around an unsecured facility, as well as a secured facility.

- Evaluate and test the capacity of the institution’s current CBS to support new products in digital format proposed including possible use of an allied credit scoring platform and mobile money platform.

During the project, the Team Leader will liaise closely with MLF Malawi senior management team and GIZ WE4F East Africa team.

- Education/training: University qualification (Master) in Project Management, Banking, Finance, Agriculture, or other relevant course of study.

- Language: Excellent business language skills in English.

- General professional experience: 10 years of professional experience in banking, finance, financial inclusion, or agri-finance sector.

- Specific professional experience: 5 years of experience in developing digital financial services for MSMEs.

- Leadership/management experience: 6 years of management/leadership experience as project team leader or manager in a company.

- Regional experience: 5 years of experience in projects in sub-Saharan Africa, of which 2 years in Malawi or southern African region.

- Development Cooperation (DC) experience: 6 years of experience in DC projects.

- Added Advantage: evidence of 5 years of work experience in (a) MSME lending projects with a focus on the agricultural sector and (b) in capacity building and ’train the trainer’ projects for financial institutions and (c) 5 years of experience in financial management of projects.

From 15 September 2022 until 31 May 2023 (Period of assignment).

Please upload your latest CV here. Please note that only shortlisted candidates will be contacted.