Background:

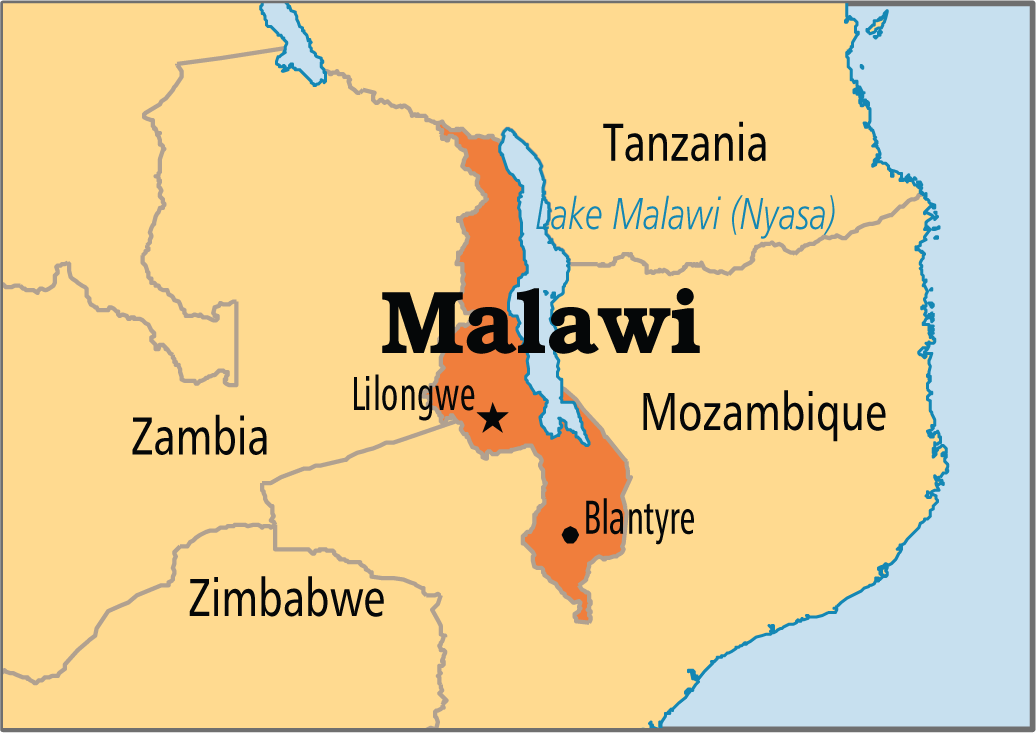

The MicroLoan Foundation Malawi (MLF Malawi) and Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) are embarking on a project to improve livelihoods of smallholder farmers through greater agricultural productivity and more sustainable practices of natural resource use in Malawi.

The project will work towards developing and testing an ESG-compliant loan product.

A second phase of the project, subject of a subsequent tender, will then focus on launching the developed financial loan product coupled with a savings product.

Project Activities/Tasks:

- Development and integration of an ESG framework into MLF Malawi’s operating procedures including but not limited to staff and clients training, loan assessment procedures, and effective ESG compliance monitoring.

- Identification of three bankable ESG compliant investment opportunities and development of business models for the demand side.

- Based on business models identified, development of two categories (secured and unsecured) of individual loan products.

- Analysis and – if necessary – strategy for adaptation of internal processes and procedures to ensure product can be rolled-out successfully.

- Assessment of the risk and impact of including men in the lending portfolio – recommendations on gender strategy.

- Training of staff in one pilot branch on ESG compliant individual loan product.

- Testing of ESG compliant digital individual loan product with 50 MSMEs and smallholder farmers

Tasks of Expert 1:

- Map internal and external structures and processes required for ESG strategy implementation and compliance.

- Develop and integrate ESG framework into MLF Malawi’s internal and external processes.

- Develop training materials in consultation with HQ staff on internal and external processes for implementation and compliance with ESG strategy. Develop staff training materials and deliver staff training to 18 HQ staff, 1 Branch Manager and Client Officers in pilot branch on ESG compliance and individual loan product.

- Develop processes for annual preparation of ESG compliance reports including mandatory Annual Environmental Performance reports.

- Coaching of selected HQ staff and brand manager on ESG compliant processes and loan product.

- Contribute to reports and analysis

- Education/training: University qualification (min. Bachelors) in Finance, Banking, International Development, or another relevant course of study.

- Language: Fluent business language skills in English, C2 or higher.

- General professional experience: 15 years of professional experience in Sustainable/Responsible Finance sector.

- Specific professional experience: 10 years of experience in ESG frameworks and strategies for Financial Institutions.

- Regional experience: 2 years regional experience in sub-Saharan Africa.

- Added Advantage: Development Cooperation (DC) experience (2.2.7): 5 years of experience of DC projects. Leadership/management experience: 5 years project management or leadership experience. Evidence of 5 years of experience in (a) implementing ESG framework for MFIs or financial institutions serving bottom of pyramid clients and (b) delivering ESG capacity building and staff training projects

From 15 September 2022 until 31 May 2023 (Period of assignment).

Please upload your latest CV here. Please note that only shortlisted candidates will be contacted.