After two years and three months, our project “Improving MSME Access to Finance” in Ghana, which we have been implementing on behalf of GIZ, has completed the project life cycle. The project had a positive influence on bringing MSMEs and financial service providers (FSPs) closer together and this way helped slightly to reduce the MSME financing gap in Ghana.

Over the course of the project, we trained 2,258 MSMEs (51% of them female entrepreneurs) across Ghana in the Northern, Bono, Ashanti, and Western Regions as well as in Greater Accra. The selection of MSMEs for the financial management training, through MSME sector associations, ensured a high level of participation in the workshops. Besides, 48 local trainers have been taught to deliver the training contents to their association peers; they gave one-on-one support for 840 additional MSMEs.

Overall, the feedback from MSMEs, gained through six focus group discussions in all project regions, reveals that, thanks to the training, most of the MSMEs now use cashbooks and take records. They further separate personal and business finances, i.e. opened a business account, save money, pay themselves a salary and are able to calculate prices and profit. Many of them also registered their businesses. Moreover, the training improved their risk management skills and they feel prepared to apply for financial products, because they take daily records and have more trust in FSPs, because they understand their financial products better now.

Jointly with the five project partner FSPs, our team adapted and developed nine innovative financial products, including three insurance products. These savings, loans, non-life and live insurance products are specifically tailored to the needs of MSMEs. The successful and lively Financial Products Launch Event attracted around 80 participants— among them representatives from the sector associations, the Ministry of Finance, the National Insurance Commission, and the Bank of Ghana. At the event, AFC project manager Oliver Schmidt stated: “We brought these partners together to jointly develop lending and insurance products that are tailored to the needs of the MSMEs and, at the same time, are good business for the financial institutions.”

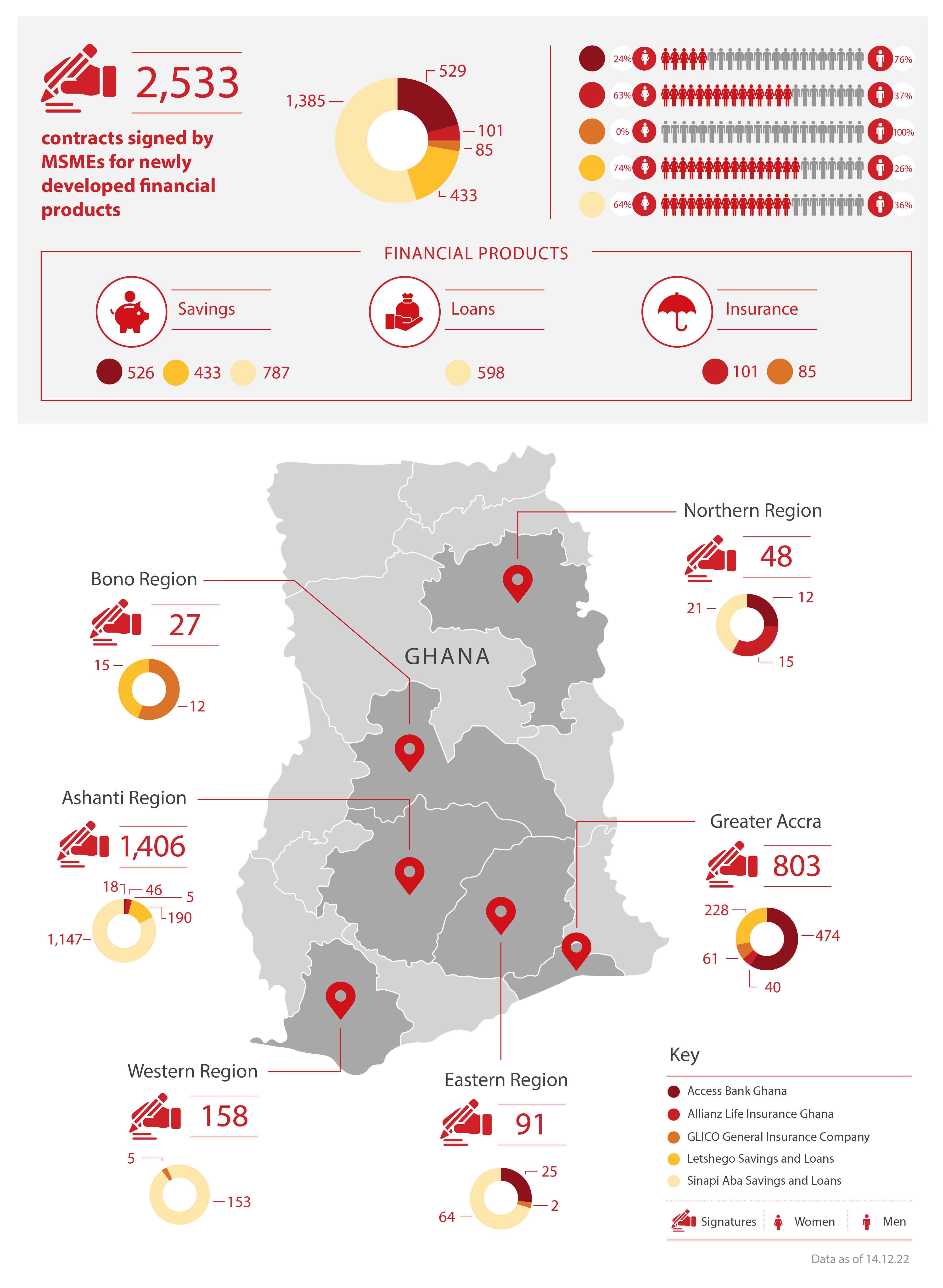

At the closing of the project, 2,533 MSMEs have signed a contract for one of the adapted/ newly developed products. The fact that 55% of them are female entrepreneurs underlines the team’s constant efforts to promote women. This endeavor took to another level with the delivery of a two-week Womenpreneur Training for 50 female entrepreneurs from all over Ghana, in cooperation with Access Bank Ghana (read more about it in our LinkedIn post)

We anticipate even further financial product signings, as the product rollout continues through FSPs’ participation in member meetings of the sector associations. Indeed, one of the key “value propositions” of the project centers on the linkage between the partner FSPs and the MSMEs through these selected sector associations. For example, the product presentations by the insurance partners at the MSME training workshops contribute to increased risk awareness and product knowledge. Another low cost model for FSP marketing of newly developed products were the successful “Access to finance” durbars, held in Tamale and Takoradi.

Box: Success factors for MSME-finance

Furthermore, 212 FSP employees were trained or benefitted from capacity building in MSME Strategy, Sales & Marketing, Financial Analysis, and Non-performing Loan Management. In addition, the project team provided industry-wide training workshops for 93 employees of micro-credit companies, rural and community banks, and insurance companies. This ensured conveying the business rationale for targeting the MSME market, and extended the project’s reach beyond the partner FSPs and its duration.

For further information please contact: Oliver.Schmidt [at] afci.de